Decoding Life Insurance: Understanding the Basics

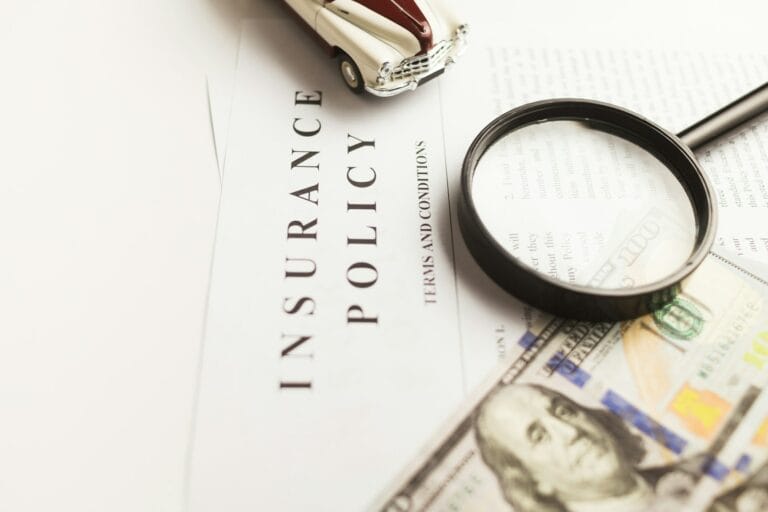

Life insurance is a crucial financial tool that provides peace of mind and financial security to individuals and their families. However, navigating the world of life insurance can be overwhelming, especially for those unfamiliar with its intricacies. In this article, we’ll unravel the mysteries of life insurance, providing a comprehensive guide to understanding the basics.

When it comes to life insurance, there are several key concepts to grasp. First and foremost, it’s important to understand the different types of life insurance policies available. Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years, while whole life insurance offers lifelong protection with a cash value component.

Next, it’s essential to familiarize yourself with the terminology associated with life insurance. Terms like premiums, death benefits, beneficiaries, and riders are commonly used but may be confusing for beginners. We’ll break down these terms and explain their significance in the context of life insurance.

Choosing the right life insurance policy requires careful consideration of various factors, including your age, health, financial situation, and long-term goals. Term life insurance may be suitable for young families looking for affordable coverage to protect against income loss, while whole life insurance offers permanent protection and cash value accumulation for those seeking lifelong security and investment potential.

Conclusion: By understanding the basics of life insurance, you can make informed decisions when selecting a policy that meets your needs and priorities. Whether you’re a first-time buyer or considering upgrading your existing coverage, our comprehensive guide provides valuable insights to help you navigate the complexities of life insurance with confidence.